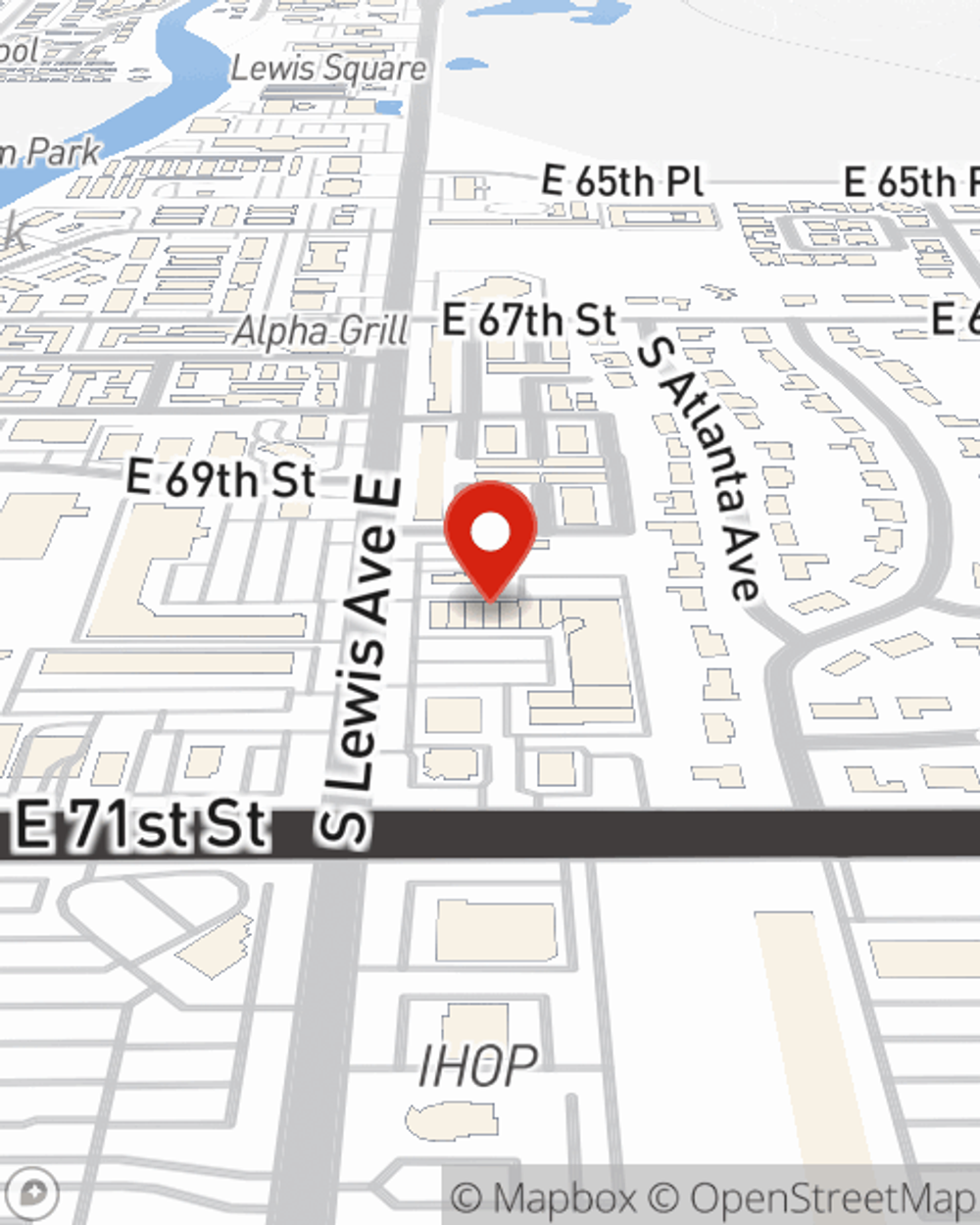

Business Insurance in and around Tulsa

One of Tulsa’s top choices for small business insurance.

This small business insurance is not risky

Business Insurance At A Great Value!

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Randy John is aware of the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to learn more about.

One of Tulsa’s top choices for small business insurance.

This small business insurance is not risky

Protect Your Future With State Farm

If you're looking for a business policy that can help cover business liability, loss of income, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Call or email the wonderful team at agent Randy John's office to explore the options that may be right for you and your small business.

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Randy John

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.